Differentiated Battery Strategy

The future of electric mobility

The one “super battery” for all electric vehicles, combining all advantages such as high performance, long lifespan, short charging times, and sustainability, is very unlikely to exist. Instead, there will be various “fit-for-purpose batteries.” According to ADAC, the specific requirements of customers and their willingness to pay will determine which battery is installed in an electric vehicle in the future.

The diversity of modern battery technologies reflects a combination of technological progress, economic pressure, and societal expectations. Factors such as the availability of raw materials, geopolitical uncertainties, and rising costs influence the choice of battery technology, as do requirements for range and growing environmental awareness. Manufacturers are increasingly responding with a differentiated battery strategy, deploying different battery types depending on vehicle segment, market conditions, and application profile.

Key Battery Types

Within lithium-ion batteries, two main cell types are particularly relevant: those based on lithium nickel manganese cobalt oxides (NMC) and those based on lithium iron phosphate (LFP).

- NMC lithium-ion batteries (Nickel-Manganese-Cobalt) are currently the preferred solution for electric vehicles due to their high energy density and compact size. They are characterized by performance and reliability and are expected to continue dominating the mid- to high-end market segments in the coming years. However, this technology also involves high material costs as well as ecological and ethical challenges in the extraction of cobalt and nickel.

- LFP batteries (Lithium Iron Phosphate) are a cost-effective and long-lasting alternative to NMC cells. They do not require expensive heavy metals such as nickel, manganese, or cobalt, making them cheaper to produce and more environmentally friendly. Although they have lower energy density, they excel in cycle stability and thermal safety. LFP batteries are particularly suitable for budget-oriented vehicle models and applications with lower range requirements, such as urban mobility. Many manufacturers already successfully use them in entry-level models and city cars.

In this context, sodium-ion and solid-state batteries also deserve special mention.

- Sodium-ion batteries are similar in structure to conventional lithium-ion batteries but use sodium instead of lithium as the charge carrier. Sodium is inexpensive, widely available worldwide, and considered more environmentally friendly to extract. A milestone was reached in December 2023 when the Chinese manufacturer JAC launched the first electric vehicles with series-produced sodium-ion batteries. A significant disadvantage of this technology is its lower energy density compared to lithium-ion batteries. Nevertheless, experts see great potential in the entry-level and low-cost segments, as well as for applications with moderate performance requirements.

- Solid-state batteries are considered a highly promising key technology for the future of electric mobility. Instead of liquid electrolytes, as used in conventional lithium-ion batteries, they employ solid materials, usually ceramic or polymer-based. This enables higher energy density, significantly improved safety, and longer battery life. Currently, however, high production costs and technological hurdles limit widespread market adoption. Series production is not expected before the end of the decade and will initially likely be confined to the premium segment.

Additionally, a wide range of other technologies is under development. Battery research continues to hold enormous potential.

Willingness to Pay as a Limiting Factor

High purchase costs remain one of the biggest obstacles to broad adoption of electric vehicles. According to a global McKinsey study, only about one-third of respondents in Europe and the U.S. are willing to pay a premium for an electric vehicle compared to an equivalent combustion engine vehicle. Worldwide, only 33 percent of potential buyers indicate that they are likely to purchase an electric vehicle under current price conditions.

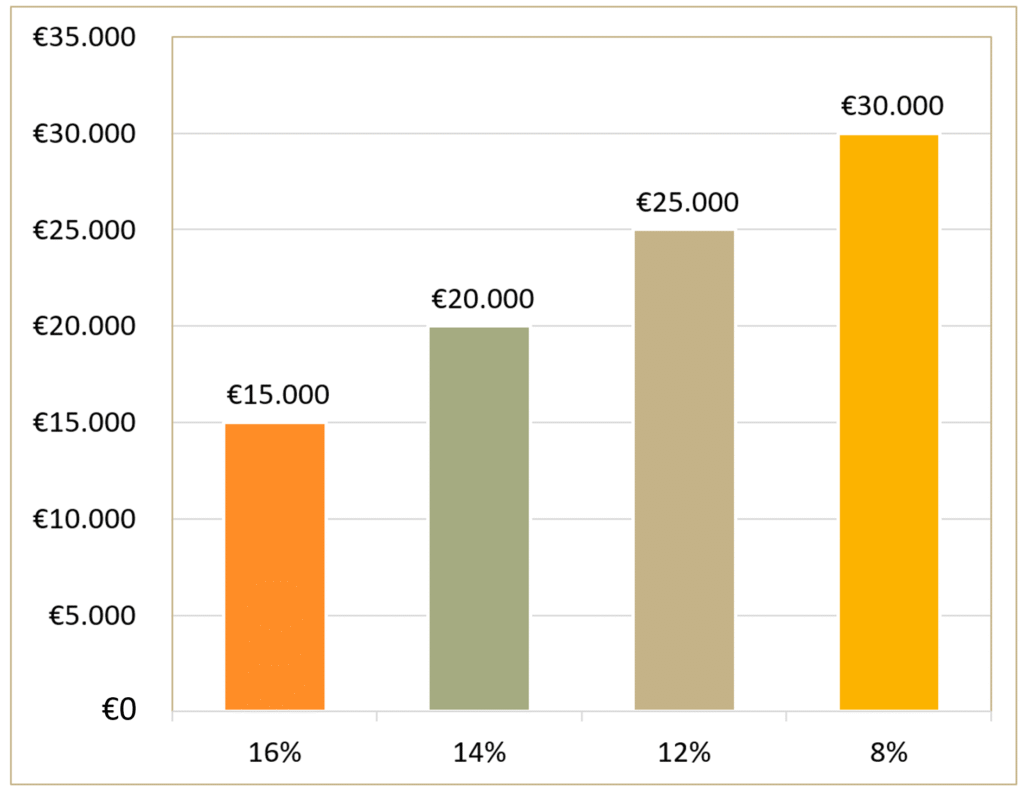

In Germany, price sensitivity is particularly pronounced. A representative YouGov survey commissioned by the German Press Agency found that 47 percent of respondents cited high purchase costs as the main reason against buying an electric vehicle. When asked about the maximum acceptable purchase price, there is a clear price gradient:

The maximum accepted Purchase Price

- 16 % indicate a limit of € 15,000

- 14 %: € 20,000

- 12 %: € 25,000

- 8 %: € 30,000

Thus, electric vehicles priced above € 30,000, which currently dominate the market, are financially unattractive for about half of potential buyers.

Many respondents also expressed a clear preference for German and European manufacturers, even though these brands are often positioned in the higher price segment. This results in a market gap in the affordable segment, which is currently insufficiently addressed – a factor that further slows the expansion of electric mobility.

Lower prices could significantly boost demand for electric vehicles. While government subsidies can create short-term incentives, they do not provide a long-term solution. Sustainable price reduction primarily requires more efficient cost structures from manufacturers, especially in battery technology, which remains the largest cost factor.

In smaller vehicle classes, the more cost-effective, though lower-performance, sodium-ion technology may gain importance. It is particularly suitable where shorter ranges are sufficient and price is a priority. Solid-state batteries, with higher energy density and better safety, are likely to prevail in the premium segment, where higher prices are more acceptable and technological advantages carry more weight.

New Differentiation Factors

Charging Time

While purchase price remains a central entry barrier, range and charging time are increasingly decisive factors in the competition between electric vehicles. According to a recent McKinsey survey, customers expect a minimum range of around 500 kilometers. Models achieving 650 to 700 kilometers stand out and enjoy higher purchase preference.

Charging time is also critical. Times of up to 30 minutes to reach 80 percent capacity are considered acceptable, provided the vehicle is charged at a low battery state. About one-third of potential buyers desire significantly shorter charging times under 20 minutes, a requirement currently met by only a few premium vehicles with modern 800-volt technology.

Range

Despite technological progress, range remains more important than charging time for most customers. Willingness to pay for additional kilometers is almost twice as high as for reduced charging time. In concrete terms, significantly more buyers are willing to pay for an extra 50 kilometers of range than for a 10-minute reduction in charging time.

For manufacturers, this necessitates deliberate prioritization depending on the target group and vehicle segment: range optimization or charging speed?

An interesting intermediate solution for range concerns is Extended-Range Electric Vehicles (EREVs). These vehicles combine an electric main drive with a small combustion engine acting solely as a generator for charging. This allows EREVs to achieve a purely electric range of 160 to 320 kilometers – significantly more than the 30 to 60 kilometers of conventional plug-in hybrids – and makes them suitable for users who mainly want to drive electrically but value the safety of additional range.

Technological Diversity as a Logical Consequence

The development of modern battery technologies is not determined solely by technical progress, but is also significantly influenced by external conditions. Raw material shortages, volatile prices, and geopolitical uncertainties make reliable long-term planning difficult and increase the economic risk for manufacturers. At the same time, the recycling of battery materials offers considerable potential: studies show that this can reduce life cycle costs by up to 45 percent.

Increasing international competitive pressure acts as an innovation driver but also intensifies price competition within the industry.

In this complex environment, it becomes clear: there will be no universal battery solution for all requirements. Which technology is used in which vehicle segment depends decisively on user expectations, application profile, and willingness to pay. Manufacturers will therefore offer various battery technologies in parallel – tailored to specific requirements for range, charging speed, lifespan, and cost. These parameters vary greatly between city cars, long-range vehicles, commercial vehicles, and premium segments.

Technological diversity is therefore not a transitional phenomenon but a permanent condition. The future of electric mobility does not lie in a single “super battery” but in the intelligent combination of specialized solutions – adapted to market, purpose, and target audience.

Doris Höflich, Market Intelligence Senior Expert

Sources:

- ADAC

- McKinsey

- Autohaus

- MRD-Wissen

- Visio Mobility / YouGov