Renewable Energy Power Supply – Navigating a Path Fraught with Challenges

As in previous years, the International Energy Agency (IEA) expects significant global market growth in renewable energy in 2023, with a record addition of new installations. Worldwide expansion of renewable power capacity is projected to surpass 440 GW, representing a 33 percent increase compared to 2022. For Germany, there are similarly positive news. The IEA estimates the total capacity of renewable energy in Germany to be over 150 gigawatts (GW) by the end of 2022 and predicts an additional 11.4 GW could be added in 2023.

News of record growth as these can often be read. They inspire confidence and lead one to believe that the energy transformation is in full swing. However, when examining the inventory data for the world and Germany, they portray a less optimistic picture. According to these, the journey towards a power supply sourced from renewable energies will be a challenge.

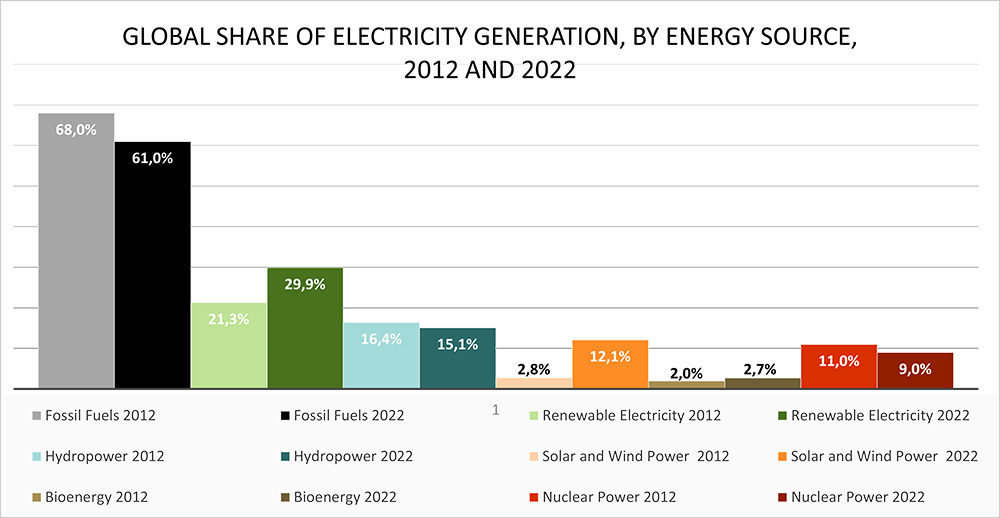

Despite the growth in renewable energy, the energy sector continues to be dominated by fossil fuels. Rising energy and commodity prices, not least caused by the Ukraine war, have led to an increased search for fossil fuels, even though many countries have committed to carbon neutrality. Additionally, the global demand for energy is on the rise, having increased by four percent in the past year, particularly in the emerging economies of Africa and Asia. According to the Global Status Report by the renewable energy network REN21, the transition to a world powered by clean energy is not yet on the horizon. The fossil fuel share in the global electricity mix has only decreased by seven percent over the past decade, going down from 68 percent in 2012 to 61 percent in 2022. During the same period, the share of renewable energy has risen from 21.3 percent to 29.9 percent.

Global share of electricity generation

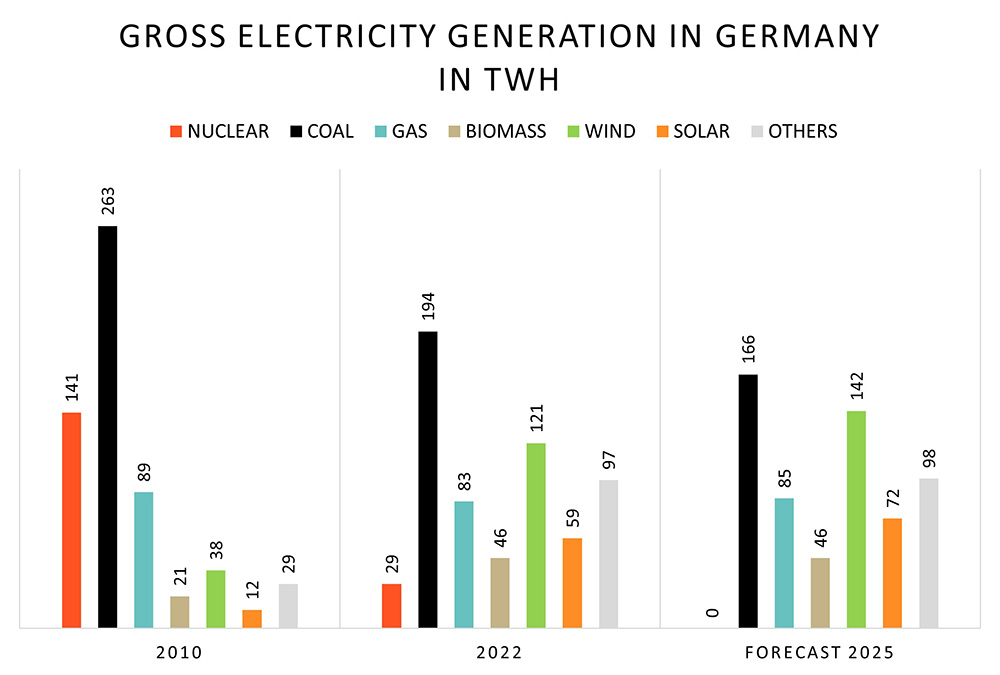

In Germany, too, conventional energy sources continue to contribute to over 50 percent of electricity generation. Coal, gas, nuclear, and other conventional sources collectively accounted for 51.4 percent of Germany’s electricity production in the first quarter of 2023. Meanwhile, wind, hydropower, photovoltaics, and biogas made up 48.6 percent during the initial three months of 2023. In terms of final energy consumption for heating and cooling, the share of renewable energies was just 17.4 percent in 2022.

Given the frequent occurrence of heatwaves, cooling is likely to become a driver of electricity demand in the coming years. The situation of renewables appears even worse in the transportation sector.

For the first time, an expert council advising the German government has presented an assessment on climate issues, indicating that Germany is at risk of missing its climate target for the year 2030. On the one hand, with its decision to phase out nuclear, lignite and coal-based energy, Germany is progressively phasing out conventional and readily available capacities. On the other hand, the demand for electricity is increasing significantly due to the growing electrification of the economy and society. The current expansion rates of renewable energies are insufficient to compensate for this trend.

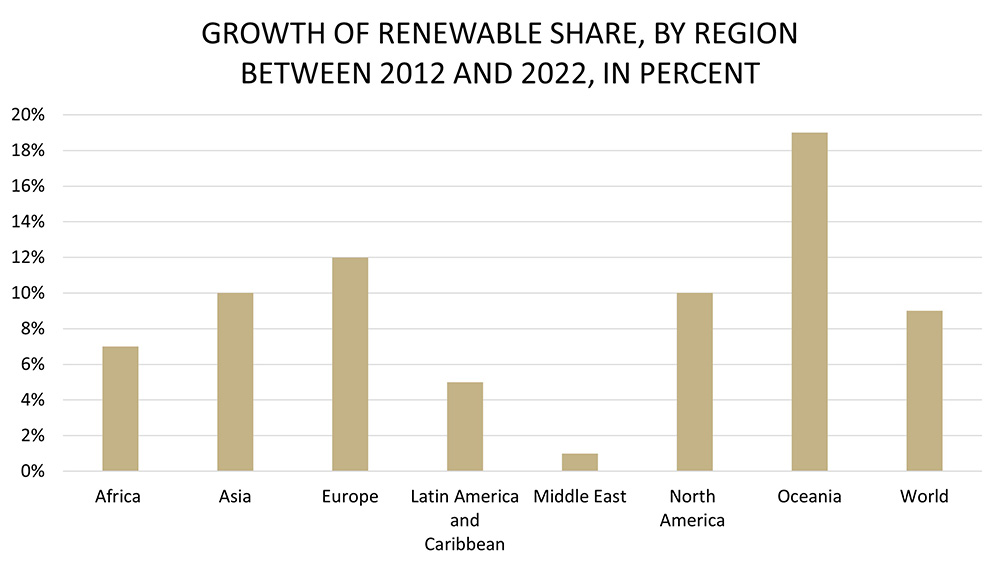

Another overarching challenge is that the expansion of renewable energies lacks balance both in terms of regions and energy sources.

In Germany, the issue of the North-South divide persists. Globally, the imbalance lies in China. In both 2023 and 2024, over half of the worldwide capacity expansion is projected to occur there. The country produces more solar energy than all other countries combined but burns half of the planet’s coal. By 2024, China’s share is set to have expanded to a record 55 Percent of global annual renewable capacity deployment. By 2024, China will deliver almost 70 Percent of all new offshore wind projects globally, as well as over 60 Percent of onshore wind and 50% of solar PV projects.

The Middle East has historically had the lowest share of clean energy in its energy mix among all the world regions, but it is beginning to address this through significant increases in renewable energy generation capacity. In many countries, financial constraints also play a significant role. The prices of components have substantially increased in general.

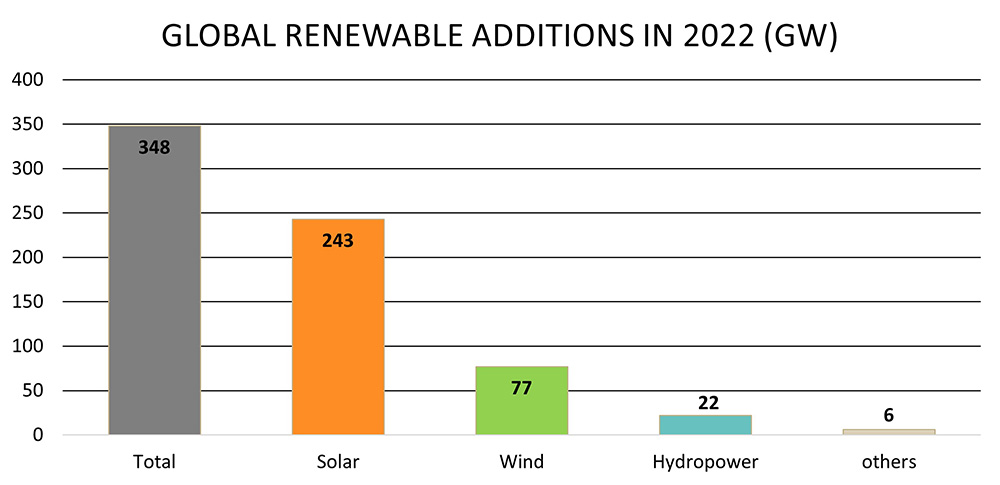

In terms of energy sources, solar and wind energy dominate the expansion of renewable energies globally. Photovoltaic and wind energy accounted for 92 percent of the worldwide increase in renewable energy capacity in 2022.

When it comes to capacity expansion, a broader spectrum of renewable energy sources should be considered. For instance, greater emphasis could be placed on bioenergy, geothermal, or even new forms of hydropower where feasible. This is particularly relevant, considering that the production of photovoltaic modules and wind turbines is heavily focused on China, leading to a dependence on this country. What will a deglobalization mean in the clean energy supply chain for efforts to combat the climate crisis?

At present, hydropower produces a greater amount of electricity than the combined total of all other renewable technologies together. It is projected to remain the largest source of renewable electricity generation worldwide until the 2030s. Therefore, it is not surprising that countries like Sweden, Norway but also Laos, Uruguay, or Gabon are mentioned in the following top-ranking list of countries with the largest share of renewables in total final energy consumption (TFEC) in 2020. Of course, Iceland is a leader in geothermal energy due to its abundant resources.

Top 10 countries with the largest share of renewables in TFEC* in 2020

- Iceland

- Norway

- Paraguay

- Laos

- Sweden

- Gabon

- Uruguay

- Brazil

- Finland

- Tajikistan

- * TFEC = total final energy consumption

Top 10 countries with the largest increase in share of renewables in TFEC* (2010–2020)

- Laos

- Sweden

- Norway

- Denmark

- Finland

- Estonia

- Ecuador

- Uruguay

- Panama

- United Kingdom

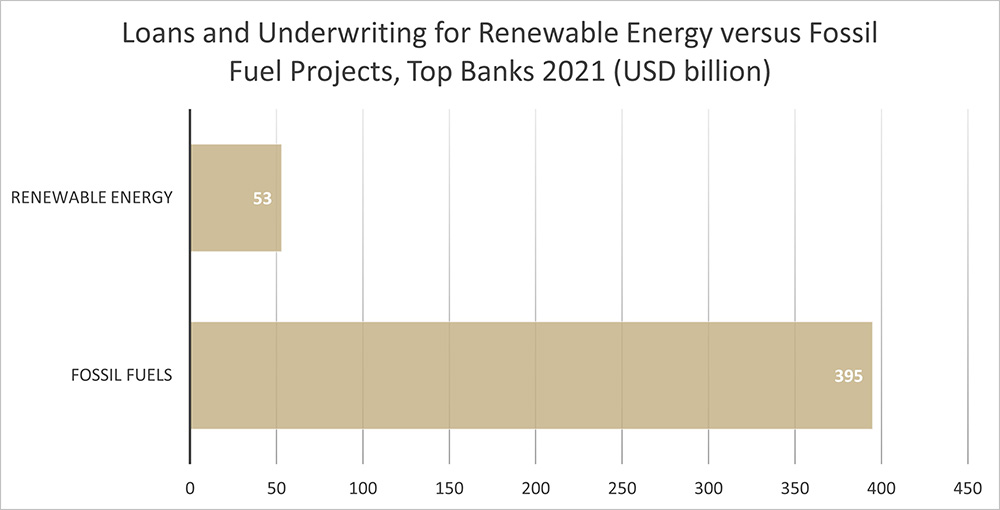

Too much is still invested in fossil fuels. In 2021, private banks provided $395 billion for fossil fuel projects, while only $53 billion were allocated for renewable energy. Out of the total energy infrastructure investments, renewables accounted for 30 percent, fossil fuels and nuclear comprised 52.5 percent, and grids and storage made up 17.4 percent. Fund managers probably do not always believe what they tell investors about ethical principles.

Loans and underwriting for renewable energy vs. fossil

The obstacles to a successful energy transition and the expansion of renewable energies are well-known. Barriers to planning and obstacles in the permit process are among the biggest challenges. This is not only the case in Germany. In Spain, for instance, numerous projects were also at risk because public administrations delayed the processing of Environmental Impact Assessments (DIAs).

For Germany to achieve its climate goals, 5.8 wind turbines with an average capacity of 4.2 megawatts each would have to be added daily from 2023 until the end of 2029, according to the Energy Economics Institute (EWI) in Cologne. However, if, as stated by the German Wind Energy Association, it takes an average of 20 months in the best-case scenario for a new wind turbine to be connected to the grid, achieving this goal within this time is unlikely.

Insufficient investments in the grid infrastructure pose the next challenge. Planning and investments must be done timely to integrate high shares of variable renewables into power systems safely and cost-effectively. Several countries in Europe – including Spain, Germany and Ireland – will reach an annual share of wind and solar PV of more than 40 per cent by 2024, which will require effective grid management to contain rising curtailment rates.

It is well-known that there is a lack of sufficient power transmission lines in Germany, as data of the Bundesnetzagentur (Federal Network Agency) show.

Grid expansion in Germany (as of 2022)

101 projects with a total length of around 12,300 km are planned.

Of these:

- around 2,600 km are still in the approval process.

- about 7,100 km are in the middle of the approval procedure.

- about 1,900 km have been completed.

The slow grid expansion in Germany is causing ever higher costs, for example, due to compensation payments to electricity producers. German energy suppliers receive compensation if they cannot feed in their electricity due to grid bottlenecks. The previous year saw a record high of these cases. According to the Bundesnetzagentur, operators of renewable energy installations had compensation claims totaling over 807 million euros in 2021. These costs are borne by electricity consumers.

Other countries face similarly big challenges. For instance, in the United States, to achieve decarbonization goals, a transmission infrastructure needs to be built that is three times the capacity of that in 2022.

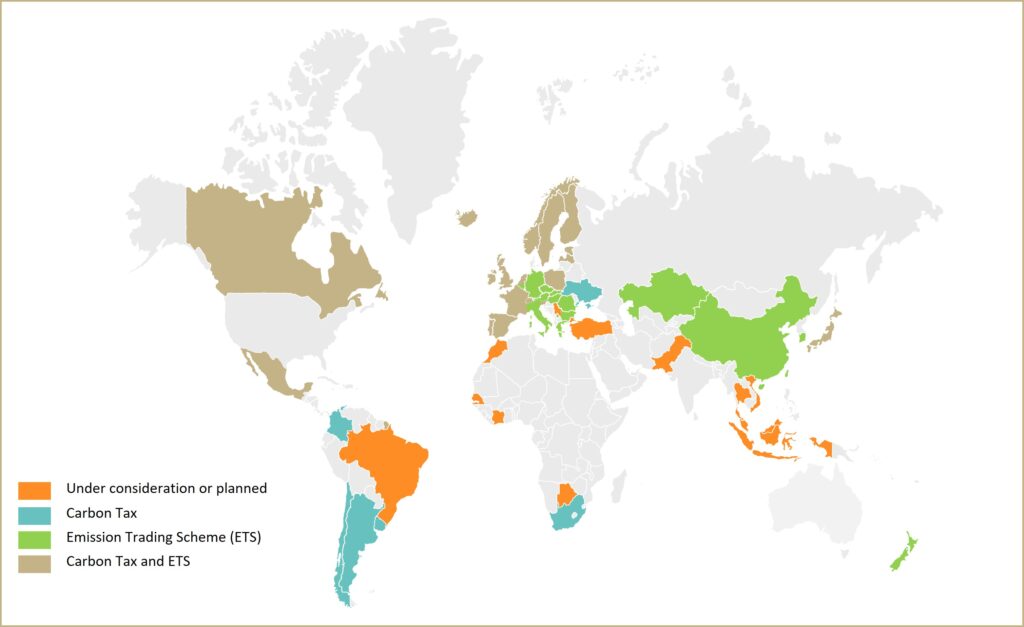

Carbon pricing is one way that countries try to reduce emissions, making those who produce emissions pay for the damage they cause, instead of telling them exactly how to reduce emissions. Currently, 46 countries are pricing emissions through CO2 taxes or emissions trading systems (ETS), and more are considering doing so. But the payments for emissions are still too low and the effectiveness against climate change is compromised by loopholes and exemptions granted to industries.

Countries and states choosing different approaches to carbon pricing based on their own circumstances and objectives.

At its core, a high price for fossil fuels, driven by increasing carbon pricing, is the best incentive for transitioning to clean renewable energy sources. Particularly, since these renewable sources are competitive and should become cheaper and cheaper. However, market mechanisms are not as straightforward as one might think.

And new concerns are emerging on the horizon. While there used to be worries about a shortage of crude oil, today it is the raw materials which are necessary for an energy transition to occur.

At the outset of the value chain for wind turbines, solar panels, electric cars, batteries, etc., are crucial raw materials such as cobalt, lithium, copper, nickel, and rare earth elements. The issue is not only their limited quantities. Rare earth elements often occur in deposits with insufficient concentrations, and mining is associated with environmental problems. Almost half of the world’s rare earth production comes from China, while the Democratic Republic of Congo holds the largest cobalt reserves globally. Dependencies and geopolitical risks have the potential to prevent renewable energy from becoming truly cheap.

The expansion of renewable energies is marked by both positive developments as well as challenges. Despite the obstacles and difficulties, there is no viable alternative; we must navigate the journey of transformation to ensure our survival on this planet.

Doris Höflich, Market Intelligence Senior Expert

Sources:

- Renewable Energy Market Update, Outlook for 2023 and 2024, International Energy Agency (IEA), June 2023;

- Renewables 2023 Global Status Report, REN 21, 18.07.2023;

- Renewables 2022 Global Status Report, REN 21, 15.06.2022;

- Daten zu Erneuerbaren Energien, Fraunhofer ISE;

- Energiewende Index. McKinsey & Company;

- Zukunftspfad Stromversorgung, Auf dem Weg zu einer sicheren, bezahlbaren und nachhaltigen Stromversorgung für Deutschland bis 2025, McKinsey & Company, Dezember 2021;

- Strommix Deutschland: Wie hoch ist der Anteil erneuerbarer Energien? NDR, 23.08.2023;

- Expertenrat stellt Bundesregierung beim Klimaschutz schlechtes Zeugnis aus, Süddeutsche Zeitung, 17. April 2023;

- Wie teuer Strom bis 2030 werden könnte, Tagesschau, 07.06.2023.